Black Friday: Private retail real estate funds fail to impress

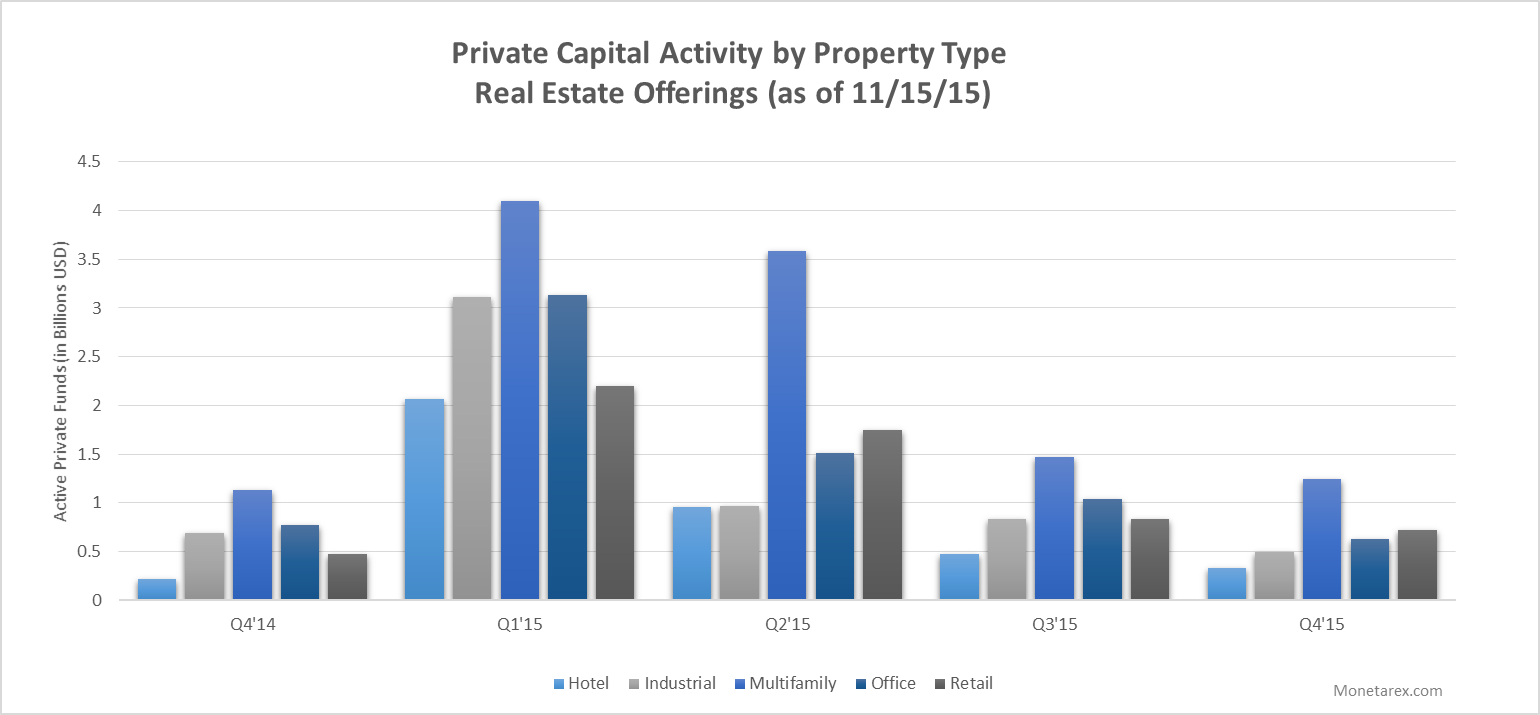

Despite some choppiness in the GDP and employment statistics this year, historically retail remains one of the most popular investment strategies for private real estate firms. It takes 18% of the total market share among the five most popular real estate product types (after multifamily at 34% and office at 21%).

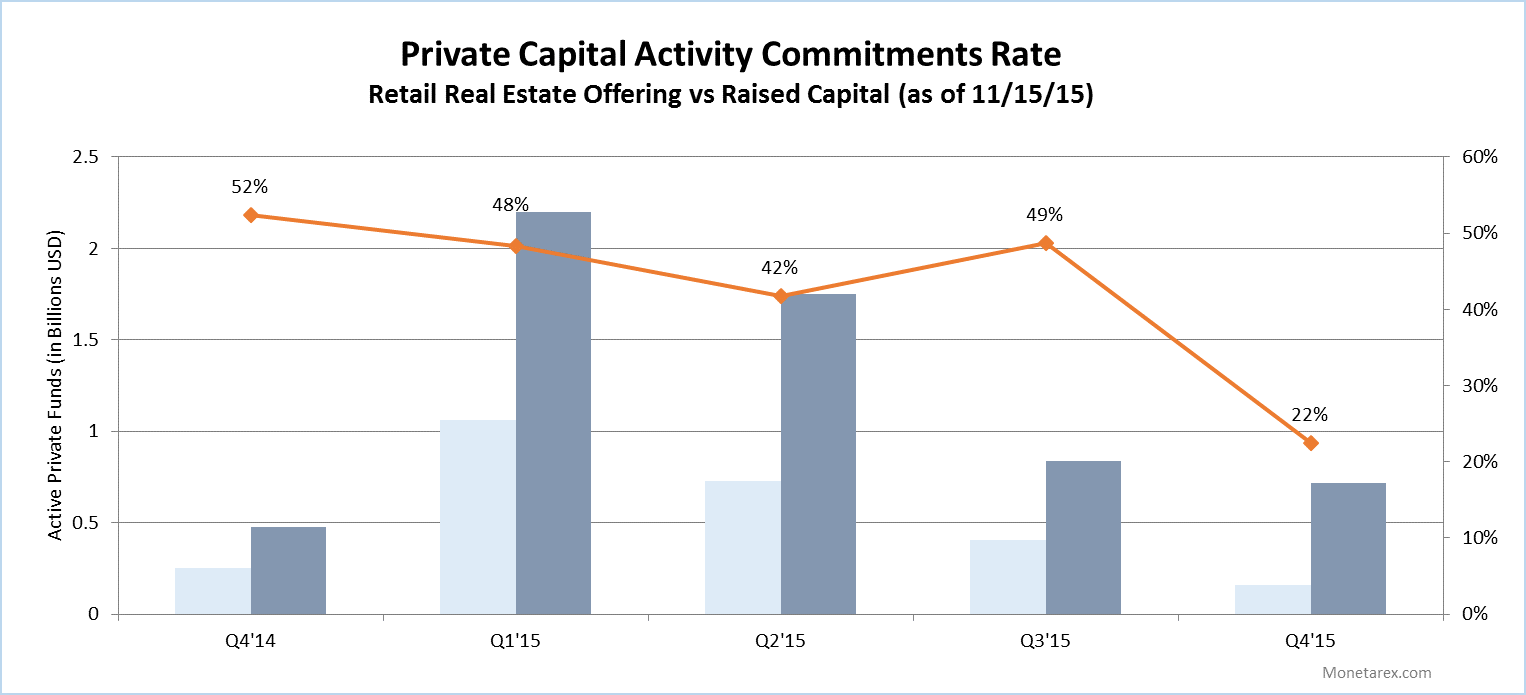

Similarly to the Black Friday shopping extravaganza, private retail real estate activity fails to impress. Our trend analysis of private real estate funds investing in retail point to a steadily slowing activity in the performance of real estate private capital. For retail real estate offerings total offering amount stands at approximately $716 million as of November 15, 2015 across 48 real estate private placements. Total offerings decreased in each of the past four quarters. Average capital commitments rate has been rather high at 44% for the past five quarters.

Total deals filed and $ capital advertised for all retail real estate private placements offer a gauge of the industry’s investment health. Total offerings in Q2 2015 decreased 14% vs Q3 2015 and a staggering 67% compared to its peak in Q1 2015.

Looking for resources to help you find private commercial real estate dealflow? Sign up for a free trial to access the data as well as in-depth real-time profiles of private companies and their investment activity.