Investment Management Technology: Metatrends

I recently spoke at the Financial Women of San Francisco event discussing the fintech innovation, solutions, and barriers in Investment Management, together with Autumn Smith, Michael Scarpa, Joana Tahiraj, moderated by Michele Alt.

Here is the recap:

- Innovations in fintech started in the 13th century and the main technologies that power most fintech products today are AI, IoT, Cloud, Big Data, Blockchain;

- Algorithm Trading, Robo-advising, Alternative Investing are all examples of the new business models and products that evolved thanks to these technologies;

- At the core of many investment products is a rule-based computer algorithm that is capable of independent thinking and self-improvement through machine learning, products that Capital Brain has been building for the real estate industry;

- In the next post I will describe the process Capital Brain goes through to build a typical machine learning investment product.

Innovations in the financial service sector date back to the 13th century when the paper check was first introduced. Since then, a series of other innovations occurred over time, including the double-entry book keeping (1400s), telegraph (1800s), credit card (1950s), Automated Teller Machine (1970s).

However, the pace of innovation accelerated with the invention of the World Wide Web (www) and the introduction of smartphone and other related technologies (e.g., AI, IoT, Cloud, Big Data, Blockchain). These are the main technologies that help speed up and automate transactions as well as reduce operational costs on both retail and institutional investors fronts.

Algorithm Trading, Robo-advising, Alternative Investing are all examples of the new business models and products that evolved thanks to these technologies.

Investment in fintech has increased over 13 times in the past 10 years from $8 billion in 2010 to over $110 billion in 2019 driven by venture investing and crowdfunding. The U.S. and China typically account for more than 80 percent of the total investment. Venture Capital and crowdfunding are major sources of capital. Financial institutions participate in Fintech through corporate venture capital, startup accelerators, or joint ventures and partnerships. Regulators are following suit by establishing regulatory sandboxes around the world.

Retail Investors

In the retail investment world there are three main fintech product themes: alternative lending, crypto currency, and robo- advisory/low-cost stock trading.

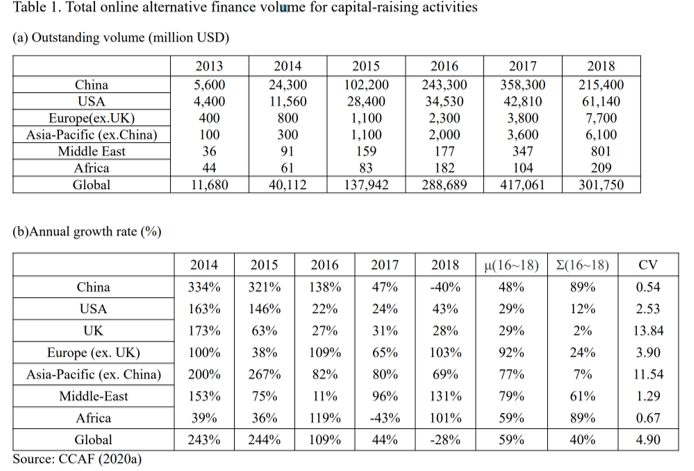

Alternative Lending: Alternative Lending grew substantially following the financial crisis when big banks were not lending. As shown in Table 1, outstanding funding volume grew globally from $11 billion in 2013 to $301.7 billion in 2018.

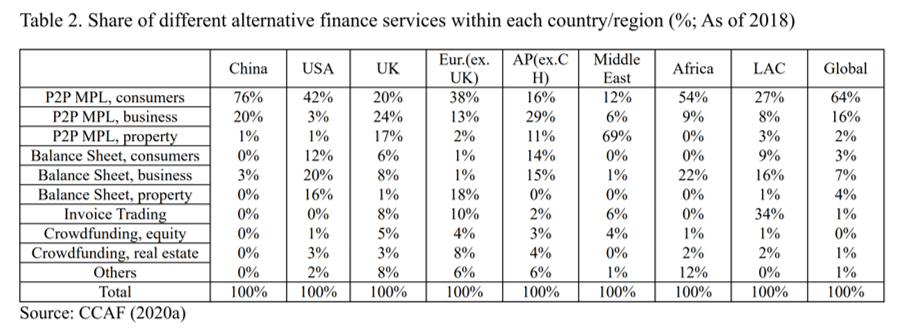

The online capital-raising activities have been proliferating in the recent years, which can be differentiated by platform characteristics (Market Place Lending, MPL, vs. Balance Sheet Lending), funding type (equity-financing, debt-financing, and reward or donation), borrower type (consumer vs. business entity), capital-raising purposes, and so on, as shown in Table 2.

P2P lenders often deploy more sophisticated data driven credit models than traditional banks and have much lower operating costs with no branches. In the US big players include Lending Club, Funding Circle and SoFi.

Low Cost Stock Trading and Investments: Alternative investment advisory service is enabled by AI and robot (aka robo-advisory). The total funding for AI-related ventures globally increased from $1.7 billion in 2013 to $15.2 billion in 2017, with ‘Banking and Securities’ having the largest funding amount.

However, robo-advisory did not live up to its expectations. Even if we take into account the covid-related quarantine times when everyone turned into a day trader while sitting at home, still from 2019 to 2020 the growth rate of the robo-advisor industry was a mere 19.3%, amounting to a total robo-adviser market size in 2020 of $987 billion, a far cry from the $2.2 to $3.7 trillion market size predicted in 2016.

Better known players in the space are startups Betterment, Robinhood, and Wealthfront. Several established firms lunched their own robo-advisory products such as Vanguard Personal Advisor, Schwab Intelligence Portfolio.

At the core of robo-advisor is a rule-based computer algorithm that is capable of independent thinking and self-improvement through machine learning. At the core of the code is usually a traditional financial theory but decisions that are made by the model improved over time with constant learning from updated data from various sources.

Bitcoin, Cryptocurrency, Digital Assets, the Blockchain and Distributed Ledger Technologies: This megatrend probably deserves a separate write up as it wins the prize for the most talked about fintech innovation. Following the drop of the bitcoin price in 2018 and the ICO crash the sector started focusing on enterprise solutions: new digital assets and derivatives, and a focus on exchange, custody and settlement infrastructure.

Even our slow to adopt real estate industry took notice – Capital Brain was approached several time to help create an investment product for crypto investing in CRE.

Perhaps, the most extreme example would be a recent sale of the digital house as an NFT for $500,000(!)

I myself started my own NFT collection focused on my mountaineering expeditions.

Institutional Investors

Two most important trends in the institutional investment management space are APIs and AI/machine learning applications.

Financial Services Infrastructure: The growth of APIs to obtain client data in the financial services sector has been explosive. The industry created an interoperable data protocol for client data sharing that most customers have no idea of and probably don’t care about but will change their engagement with providers, hopefully for the better.

AI/Machine Learning Applications: Data growth is also driving the big data, machine learning and AI products. In the next post I will describe the process Capital Brain goes through to build a typical machine learning investment product.

If you want to learn some valuable tips on using machine learning in your real estate fund operations, please reach out Contact Us

Sources:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3914569

https://digitalintheround.com/robo-advisor-statistics/ (Statista)