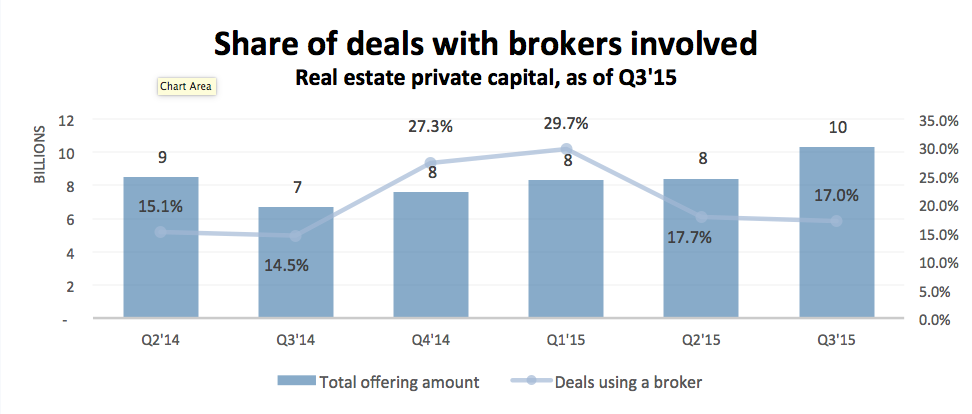

Crowdfunding platforms don’t diminish the role of the traditional broker-dealer

Monetarex analyzed private placement filings dating back to 2012 in an effort to determine whether the compensation structures for private commercial real estate sponsors have been affected by the heated up commercial real estate market in the United States.

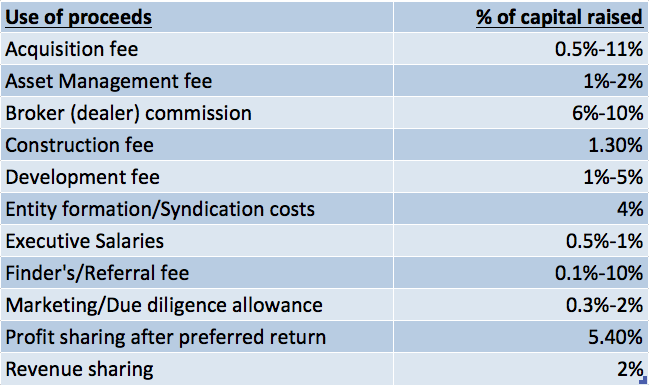

Typical fees for 2012-2015 period are broken down in the table below. When it comes to expenses, a typical private placement deal includes selling commissions, allowances for marketing and due diligence expenses, dealer and placement agent fees, any formation and legal expenses. After the funds are raised the General Partner of the Issuer is entitled to management fees paid by the Issuer and a share of the profits of the Issuer. Acquisition and asset management fees are charged, the promote and revenue sharing compensation structures are applied.

Asset management fee: usually 1%-2% paid of net invested capital paid monthly or quarterly.

Broker-dealer or real estate broker commissions: assumes that all units will be sold by broker-dealers and that the broker-dealers will be paid a commission in a 6%-10% range of offering proceeds. Sometimes a portion of that commission is converted into equity in the Issuer, in other words the commission is paid in shares in lieu of a fee.

Organizational fees: there are fees for property acquisition, organizing and forming the Company, allowance to broker-dealer for marketing and due diligence (typically around $10,000 regardless of the fund/deal size), $25,000 annual compliance fee, and $25,000 base fund fee. $6,000 -$20,000 is paid to in the form of legal fees for preparation of SEC filings, Executive Summary, and Private Placement Memorandums. Typically, approximately 4% of the gross proceeds is used for organization and marketing expenses.

Development and/or Construction Management cost: usually around 5% and not to exceed 10% of the project cost.

Executive salaries: executive officers and directors receive around $50,000 each in annual compensation for funds/deals under $10 million, compensation goes up to around $100,000 each for funds/deals over $10 million.

Promote or revenue sharing compensation: some funds/deals receive up to 5% of the total gross income generated from operation of the properties. When it comes to the promote, 50/50, 80/20 or 70/30 splits are common. The data suggests these splits are not correlated with the size of the fund in any way. Rather, they are tied to a performance of the portfolio. For instance, if a greater than 10% investor return is achieved, there is a 80/20 split of profit with the manager until a 12% annual return; thereafter, a 70/30 split.

As shown in the graph above, the rise in popularity of crowdfunding platforms did not affect the use of traditional broker-dealers. On average, every fifth deal uses a licensed real estate professional (either a commercial broker or a broker-dealer) for fundraising activities paying out commission in the 6%-10% range of the funds raised.

Looking for resources to help you find private commercial real estate dealflow or investment partners? Sign up for a free trial to access the in-depth real-time profiles on over 2,000 private real estate companies.