CBAI 0323: Multifamily – leading property type

With the rise of adoption of artificial intelligence in the financial sector, the analysis of the market is getting more precise and detailed. By rigorously applying the latest advances in machine learning and probability theory, the models stay objective in their allocations.

One example, the AI-run CBAI REIT strategy, a long-only long-term strategy with quarterly reallocation with about 40 REIT stocks held in the portfolio at any given quarter. The algorithm largely ignores the macro sentiment and does not take into account consensus estimates. It focuses on company fundamentals instead.

The algorithm identifies the top 25 factors that historically have been correlated the best with the future value of the REIT Market Cap. Every quarter the model is updated through a machine learning loop to feed latest financial results. Analyzing the results for all public REITs allows engineers to optimize the returns in the portfolio with REITs that are most likely to have the highest share price based on the past fundamentals performance.

CBAI Probabilistic Approach strategy takes all four REIT specific fundamental categories into account, factors with highest correlation to market capitalization movements greatly impact conditional probabilities and thus are selected, rated and as a result a single probability of growth is returned. The current version takes into account all US REITs and its fundamentals data; prior probability of total market growth (macroeconomic factors) is currently set as neutral to the algorithm.

In March 2023 the CBAI model portfolio achieved -5.37% vs -6.04% return for NAREIT benchmark. Overall, the CBAI model portfolio continues to outperform the NAREIT benchmark. The CBAI model portfolio outperformed NAREIT by 700+ bps y/y on a trailing 12 months basis, outperforming the benchmark in 6 out of 12 monthly reporting periods. Since the start of the CBAI model portfolio in February 2021 the cumulative return has been 579% vs NAREIT return of 387%.

Even if the market is declining the CBAI algorithm takes not monthly but a long-term perspective based on a fundamental analysis.

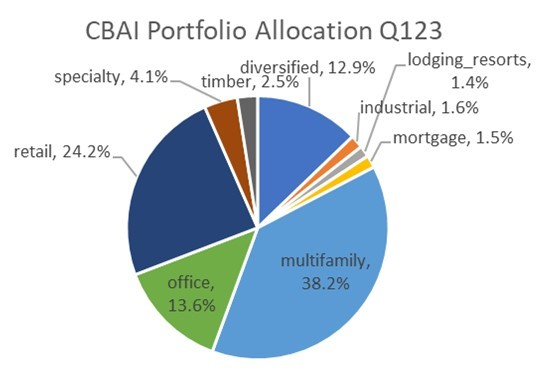

We make quarterly rebalancing with about 30% turnover. After the rebalancing analysis on February 15, 2023 the CBAI model holds positions in 23 REIT stocks with 38.2% of its portfolio in multifamily REITs with AvalonBay Communities (AVB), Equity Residential (EQR), and Mid-America Apartment Communities (MAA) being the largest holdings. Retail REITs constitute 24.2% of the portfolio with top REITs Simon Property Group (SPG), Regency Centers Corporation (REG), and Agree Realty Corporation (ADC). The third largest property sector is office with 13.6% allocation (Boston Properties (BXP), Kilroy Realty Corporation (KRC), and SITE Centers Corp (SITC) are the largest holdings).

Despite some worrisome current market trends that are discussed below, apartment REITs have been some of the strongest-performing REITs over the long-term term period. From 2010 through 2022, apartment REITs delivered average annual returns of 15.0%, outpacing the 10.4% annual total returns for all REITs.

Rising debt costs have contributed to the decreased apartment transaction volumes with few deals closing in Q1’23. High interest rates make it difficult to achieve the yields investors expect. They are in search of higher rates of returns and are choosing to stay cautious and invest less right now. Many still look for value-add deals with an opportunity for very strong rent growth.

Inflation remains stubbornly high. The central bank is making it clear that it will hold rates high for as long as it takes to get prices under control – and the effects of all of this are still rippling through the economy.

The housing sector is reeling under it. The higher price of financing has pushed home sales down; mortgage applications are at their lowest level.

There are sectors that stand to gain should the housing market continue its contraction, multifamily being one of those sectors. The largest publicly traded owners of multifamily properties have reported continued profits and growing rents in their Q4’22 earnings calls. Analysts expect that slowing growth of rents will be just a normalization towards historical averages and not the steep decline that might endanger the multifamily REITs stocks performance.

The uptick in multifamily supply growth might negatively affect the multifamily REITs stocks performance. However, this uptick comes alongside a decline in single-family development. Single-family housing starts are at the lowest levels in nearly a decade. Freddie Mac estimates that the U.S. housing market is still 3.8 million housing units short of what’s needed to meet the country’s demand with 29 states that have housing deficit.