CBAI 0922: Why CBAI is 40% in multifamily

A sharp correction in REIT share prices in the first half of 2022 and quite a bit of volatility in recent months triggered a sell call in the CBAI portfolio, it went into “100%” cash. The call proved to be correct as NAREIT benchmark lost 7.27% in the month of June alone. CBAI reentered the market at the end of September 2022.

For September 2022 the CBAI model portfolio achieved -10.07% vs -13.19% return for NAREIT benchmark. The CBAI model portfolio continues to outperform the NAREIT benchmark. Overall, the CBAI model portfolio outperformed NAREIT by 987 bps y/y on a trailing 12 months basis, outperforming the benchmark in 9 out of 12 monthly reporting periods. Since the start of the CBAI model portfolio in February 2021 the cumulative return has been 476% vs NAREIT return of 359%.

Even if the market is declining the CBAI algorithm takes not monthly but a long-term perspective based on a fundamental analysis.

REITs share prices have corrected in the second half of 2022 and many are trading at attractive valuations. Fundamentals are strong, leverage remains at all times low at about 35%. Employment remains strong. The bulk of interest rate increase has occurred and the investor sentiment is being adjusted accordingly. Many REITs are hiking their dividends (and as Charlie Munger says ‘If it does not cash flow just say No’).

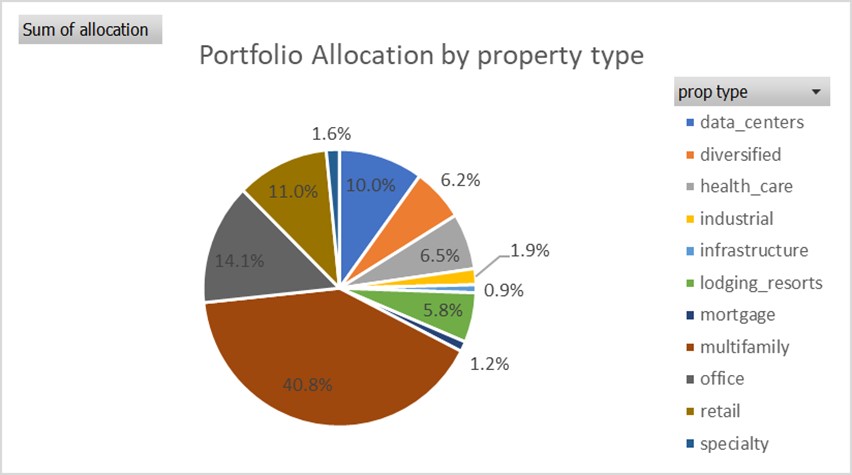

We make quarterly rebalancing with about 30% turnover. After the rebalancing analysis on August 15, 2022 the CBAI model holds positions in 33 REIT stocks with 40% of its portfolio in multifamily REITs with AvalonBay Communities (AVB), Equity Residential (EQR), and Sun Communities (SUI) being the largest holdings. Office REITs constitute 14% of the portfolio with Boston Properties (BXP), Kilroy Realty Corporation (KRC), and Highwood Properties (HIW) being largest holdings.

40% allocation to the multifamily sector makes sense. Long-term prospects for the multifamily sector REITs are good: strong fundamentals, balance in supply and demand due to construction lagging housing formation of the past several years. The market is not overbuilt this time around.

Multifamily REITs have survived COVID and are now enjoying the recovery. The CBAI algorithm for Q3’22 tells us that Revenue and Investments line items correlate the most with the performance of the share price throughout the quarter so these are the metrics we will be closely following in the news. Case in point: AVB, the largest multifamily holding in the portfolio has a $4 billion investment pipeline with the CBAI correlation value of 0.81 (the closer to 1 the better), its Revenue at $650 million as of Q2’22 is the highest in the past two years with the CBAI correlation value of 0.54. Any AVB news affecting the performance of these two line items will correlate the most with the performance of the stock and the Market Cap in Q3’22.

Philosophy: CBAI (completed in 2021 after 3 years of development by a team of PhDs and data scientists) is a REIT strategy run by an AI and machine learning algorithm. The CBAI REIT product is a long-only long-term strategy with quarterly reallocation with about 40 REIT stocks held in the portfolio at any given quarter.

We do not have a crystal ball – we believe in data science and measuring what we can measure to decrease the risk. By rigorously applying the latest advances in machine learning and probability theory, we let the model stay objective in its allocations. The algorithm largely ignores the macro sentiment and does not take into account consensus estimates. It focuses on company fundamentals instead. See full Methodology.

We identify the top 25 factors that historically have been correlated the best with the future value of the REIT Market Cap. Every quarter we update the model through a machine learning loop to feed latest financial results. Analyzing the results for all public REITs allows us to optimize the returns in the portfolio with REITs that are most likely to have the highest share price based on the past fundamentals performance.

However, like every investing tool, CBAI algorithm has its limitations, and should not be used alone for making an investment decision.

Disclaimer: Capital Brain, Monetarex, Inc and its employees are not Registered Investment Advisors or Financial Planners. The research reports and AI/ML algorithms and other market intelligence are provided for information purposes only. Our research and AI/ML algorithms do not constitute investment advice and readers should not make any investment decision without conducting their own due diligence or consulting their financial advisor about their specific situation.