Healthcare Shocker

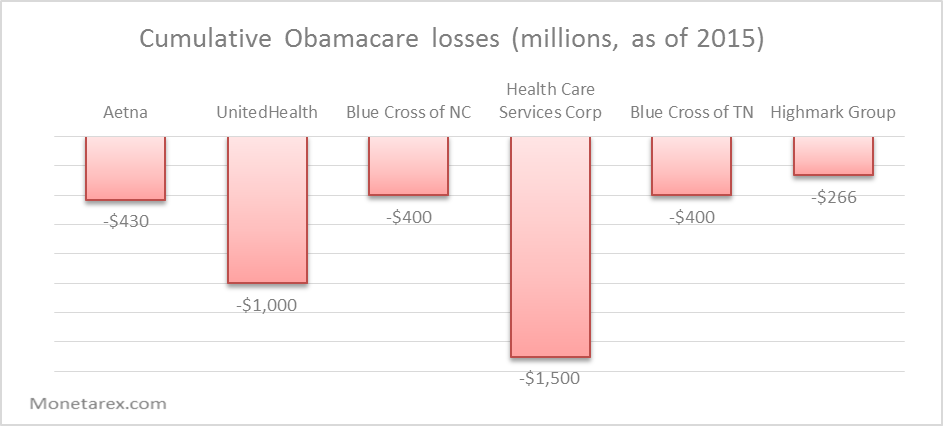

In a move that’s sure to raise everyones’ blood pressure, insurance provider Aetna has announced that it’ll no longer be partnering with Obamacare in the 11 states that it once covered under the plan. An estimated 167,600 patients will be dropped from the program, most of which are in rural southern areas of the nation. The move came after the insurer said too many high risk patients signed up for the program, pushing premiums too high.

The question is now whether these decisions are the beginning of a trend, or if the current providers can find a way to continue working with Obamacare. One thing is certain though— rising costs and aging populations are surely a good thing for healthcare CRE investors, with not enough healthy people to offset the rest of the population.

Our analysis of private real estate funds investing in healthcare assets point to a steady activity in the performance of real estate private capital. For healthcare real estate offerings total offering amount stands at approximately $304 million as of August 25, 2016, just a 1% increase compared to the same period last year. Total offerings have been filed at a steady level in each of the past four quarters and average capital commitments rate has been at 21%, twice below the average commitment rate across all asset types.

The Obama administration is not concerned about the decision. While there are many insurance providers dropping coverage, the administration says that changes and adjustments should be expected. When UnitedHealth exited, there was alarm, though their involvement in the Affordable Care Act was relatively small; coming in at 6% of all enrollees, its plans more expensive than other insurance providers. The carrier responsible for the most voluntary exchange exits?

Currently, there are 287 exchange-participating insurers. This is down from 307 in 2015, and much lower than the 395 insurers that offered individual market coverage in the 50 states and District of Columbia in 2013, just prior to the ACA taking effect.

Blue Cross and Blue Shield of Minnesota, the state’s largest insurer, expects to drop individual plans beginning next year. “We can’t offer something for sale in this marketplace that we know every time it’s purchased we’re losing money,” CEO Bradley Wilson explained in a statement. The biggest state losers are those who have only one provider; Alaska, Alabama, and Wyoming can only turn to Blue Cross and Blue Shield, while Pinal County in Arizona is the first county in the nation to have no ACA providers.

Selected healthcare deals for Q3’16:

| Investment Vehicle | Sponsor | Deal Size |

| Rotunda Medical Properties, L.P. | Crescendo Commercial Realty | 2,825,000 |

| Realion, Inc. | Everest Medical Core Properties | 2,500,000 |

| Heartis Orland Park Partners, L.P. | Caddis Partners | 10,200,000 |

| Edward HC MOB, LP | HealthCap Partners, LLC | 3,275,000 |

| Hilton Head ASC Partners, LP | Caddis Partners | 2,825,000 |