Multifamily: Overbuilding and Concessions

Slowdown in Multifamily Private Deals

Apartment Operator Aimco has just inked a $320 million deal in Redwood City for a 463-unit apartment community— and 18% has already been leased before construction has been completed. TIAA Global Asset Management invested $212 million in multifamily developer Greystar for a 305-unit project in the same city. That’s $700,000 per unit.

There’s no denying that multifamily real estate is a popular asset. Yet, recent CBRE reports indicate that demand for these multifamily assets are slowing down. These markets are cooling off due to overbuilding, with San Francisco partly to blame; over 8,000 units have been built in the city since 2011, with the average rent at $3,600 per unit in Q2 2016. While another 3,000 units expected to be completed by the end of 2016, rent prices are likely to see a dip. Economics professors rejoice: their theories of rent control being unnecessary have been proven right through the over-saturation of high-end condos. On the East Coast, landlord start offering outsized concessions for newly build apartments. According to Citi Habitats, 19% of leases in Manhattan included a concession.

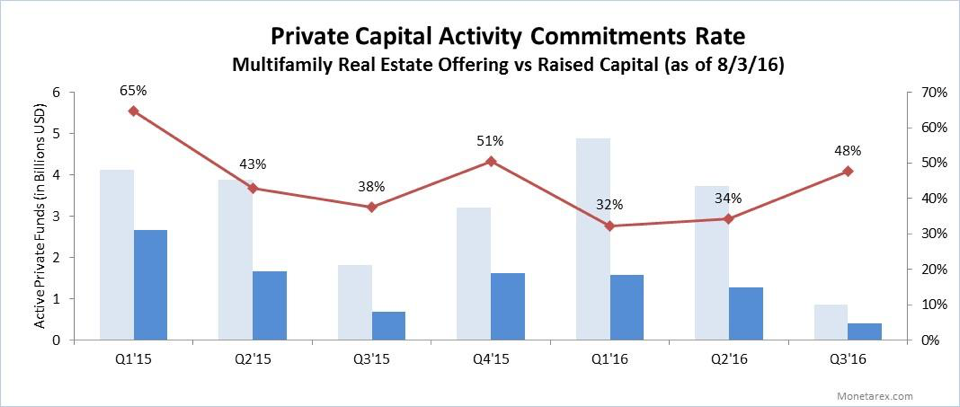

Our analysis of private real estate funds investing in multifamily assets point to a steady activity in the performance of real estate private capital with multiple positive trends. For multifamily real estate offerings total offering amount stands at approximately $3.7 billion as of June 30, 2016 roughly in line with the same period last year. Total offerings stayed at a steadily high level in each of the past four quarters and average capital commitments rate has been rather high at 48%.

Total deals filed and $ capital advertised for all multifamily real estate private placements offer a gauge of the industry’s investment health. Multifamily product type has been very active with around $3 billion per quarter being raised. Total offerings for Q3 2016 are on pace with/ compared to Q3 2015.

Looking for resources to help you find private commercial real estate dealflow? Sign up for a free trial to access the data as well as in-depth real-time profiles of private companies and their investment activity.