No need to worry: private multifamily real estate funds are doing great

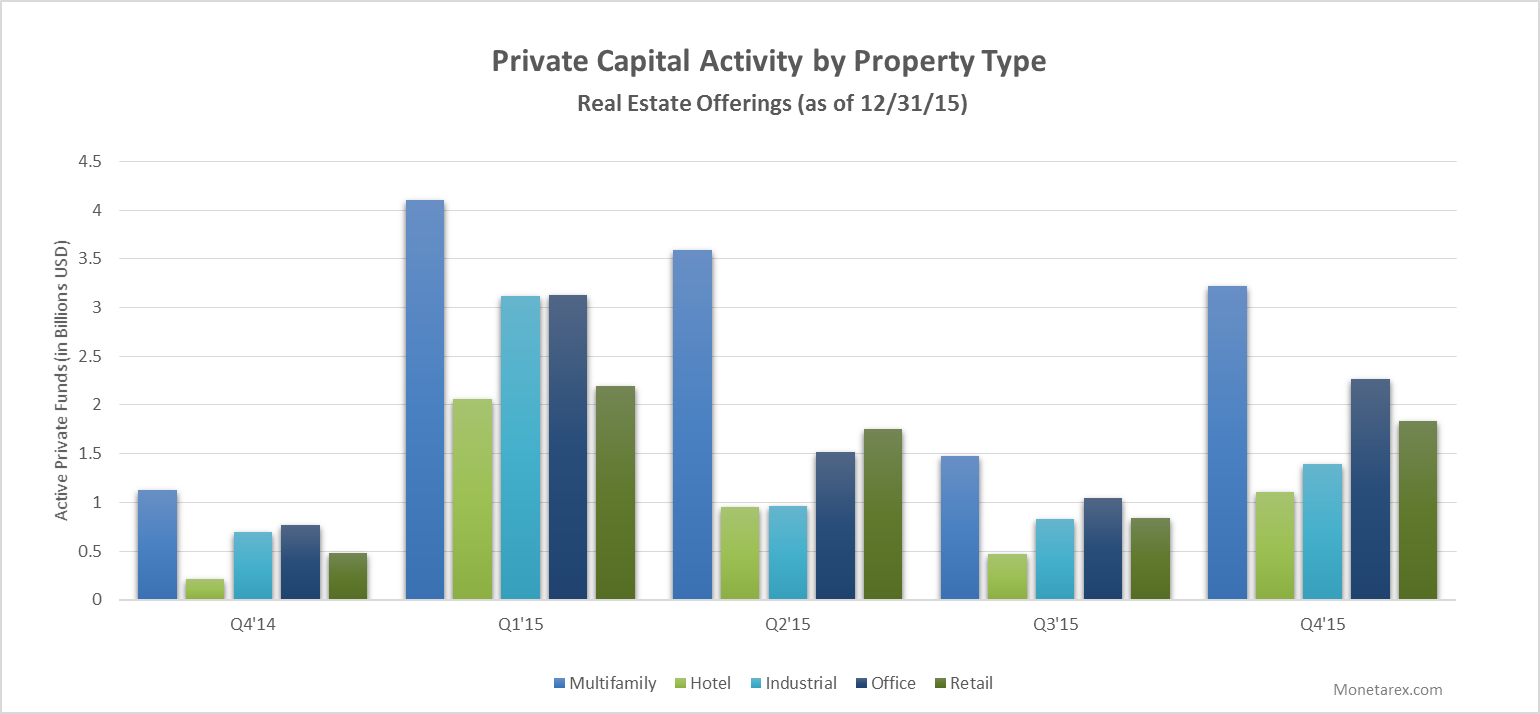

With the continuing “desuburbanization” and the Millennials’ preference for simpler uncluttered life, multifamily remains the most popular investment strategy for private real estate firms. Multifamily takes 34% of the total market share among the five most popular real estate product types (office is the second most popular at 22%).

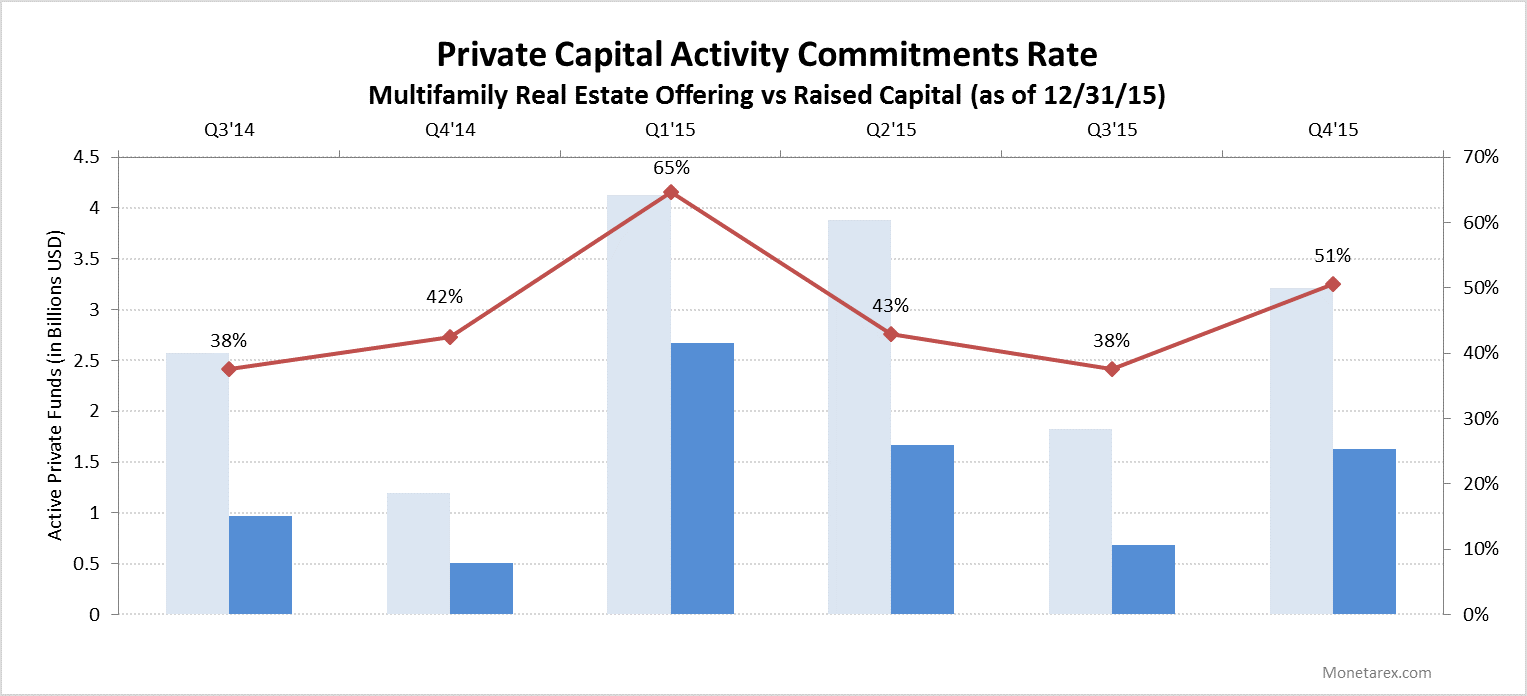

Our analysis of private real estate funds investing in multifamily assets point to a steady activity in the performance of real estate private capital with multiple positive trends. For multifamily real estate offerings total offering amount stands at approximately $3.2 billion as of December 31, 2015 across 330 real estate private placements (almost half (!) of all deals analyzed). Total offerings stayed at a steadily high level in each of the past four quarters and average capital commitments rate has been rather high at 51% in the last quarter of the year.

Total deals filed and $ capital advertised for all multifamily real estate private placements offer a gauge of the industry’s investment health. Multifamily product type has been very active with around $3 billion per quarter being raised. Total offerings in Q4 2015 increased a staggering 185% compared to Q3 2014.

Looking for resources to help you find private commercial real estate dealflow? Sign up for a free trial to access the data as well as in-depth real-time profiles of private companies and their investment activity.