CBAI 1222: Strong fundamentals in the self-storage sector

With the rise of adoption of artificial intelligence in the financial sector, the analysis of the market is getting more precise and detailed. By rigorously applying the latest advances in machine learning and probability theory, the models stay objective in their allocations.

One example, the AI-run CBAI REIT strategy, a long-only long-term strategy with quarterly reallocation with about 40 REIT stocks held in the portfolio at any given quarter. The algorithm largely ignores the macro sentiment and does not take into account consensus estimates. It focuses on company fundamentals instead.

The algorithm identifies the top 25 factors that historically have been correlated the best with the future value of the REIT Market Cap. Every quarter the model is updated through a machine learning loop to feed latest financial results. Analyzing the results for all public REITs allows engineers to optimize the returns in the portfolio with REITs that are most likely to have the highest share price based on the past fundamentals performance.

CBAI Probabilistic Approach strategy takes all four REIT specific fundamental categories into account, factors with highest correlation to market capitalization movements greatly impact conditional probabilities and thus are selected, rated and as a result a single probability of growth is returned. The current version takes into account all US REITs and its fundamentals data; prior probability of total market growth (macroeconomic factors) is currently set as neutral to the algorithm.

A sharp correction in REIT share prices in the first half of 2022 and quite a bit of volatility in recent months triggered a sell call in the CBAI portfolio, it went into “100%” cash. The call proved to be correct as NAREIT benchmark lost 7.27% in the month of June alone. CBAI reentered the market at the end of September 2022.

For November 2022 the CBAI model portfolio achieved 5.35% vs 6.02% return for NAREIT benchmark. Overall, the CBAI model portfolio continues to outperform the NAREIT benchmark. the CBAI model portfolio outperformed NAREIT by 605 bps y/y on a trailing 12 months basis, outperforming the benchmark in 7 out of 12 monthly reporting periods. Since the start of the CBAI model portfolio in February 2021 the cumulative return has been 514% vs NAREIT return of 367%.

Even if the market is declining the CBAI algorithm takes not monthly but a long-term perspective based on a fundamental analysis.

REITs share prices have corrected in the second half of 2022 and many are trading at attractive valuations. Fundamentals are strong, leverage remains at all times low at about 35%. Employment remains strong.

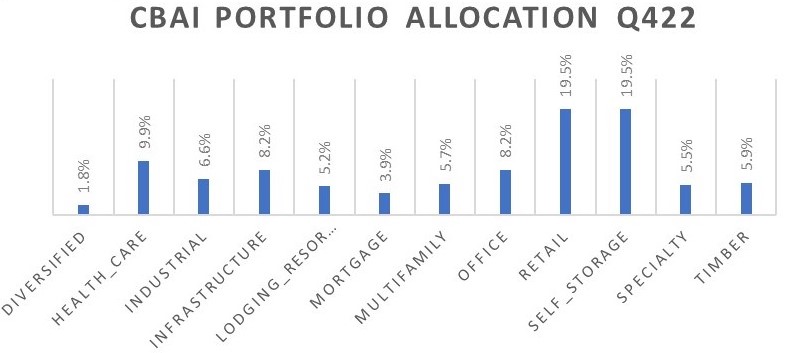

We make quarterly rebalancing with about 30% turnover. After the rebalancing analysis on November 15, 2022 the CBAI model holds positions in 51 REIT stocks with 19.5% of its portfolio in self-storage REITs with Public Storage (PSA), Extra Space Storage, Inc. (EXR), and CubeSmart (CUBE) being the largest holdings; CBAI holds positions in the three out of five largest self-storage REITs. Equally, retail REITs constitute 19.5% of the portfolio with Realty Income Corporation (O), STORE Capital Corporation (STOR), and National Retail Properties, Inc. (NNN) being the largest holdings. The third largest sector is health care REITs with 10% of the total portfolio.

19.5% allocation to the self-storage sector makes sense. Based on recent performance and past recession resilience, the self-storage sector remains extremely well-positioned to continue to deliver strong operating metrics.

Self-storage REITs in 2021 showed a whopping 80% increase when demand for self-storage boomed during pandemic.

In recent months despite the rising interest rates, self-storage REITs managed to keep the operational performance intact. The worst of the interest rate increases is now likely behind us and the self-storage REITs have solid balance sheets to take advantage of the reviving acquisition market.

However, in the short-term it is important to watch for the impact of the economic downturn on the self-storage REITs performance. Due to the short-term nature of self-storage leases, the sector has more exposure to an economic downturn. The demand in the sector is driven by relocation and the changing life circumstances. If there is less turnover in the residential market (fewer people move and buy/sell houses), the demand for self-storage wanes.

Public Storage (PSA) is the largest holding in CBAI REIT portfolio with 10% allocation.

Public Storage is not only the largest self-storage REIT but also stands out with its robust development pipeline. The rest of the self-storage REITs primarily expand through acquisitions. This development strategy delivers higher returns compared to its peers.

Extra Space Storage, Inc. (EXR) is 5.06% of CBAI REIT portfolio.

The main competitive advantage of Extra Space Storage, Inc. is its robust third-party property management which provides a steady revenue and requires little capex.

CBAI REIT’s allocation to CubeSmart (CUBE) is at 2.20%.