Intelligent Underwriting: Machine Learning use cases in real estate 2

In light of recent Covid-19 events we are summarizing the ways machine learning and AI can help real estate industry handle the changes, weather the storm, and take advantage of new opportunities.

Machine Learning Use Case 2: Intelligent Underwriting

Primary User: Investment Manager, Acquisition Teams

Value Proposition:

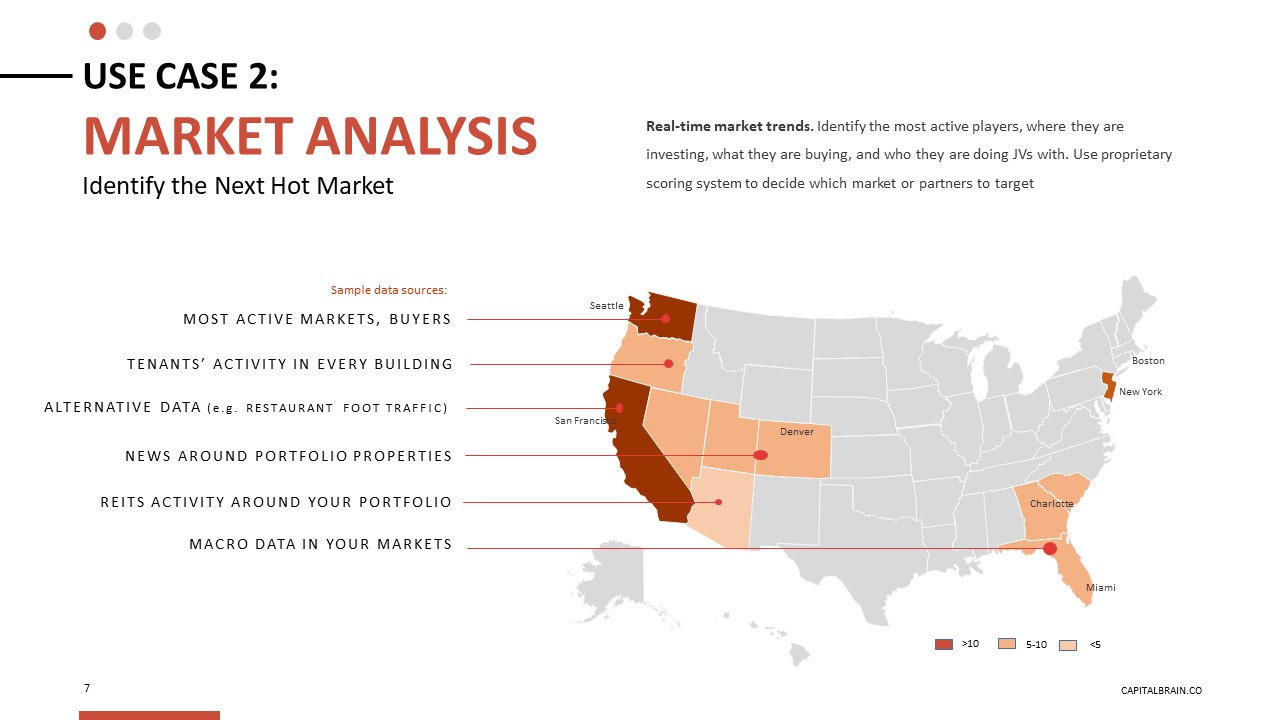

- Identify the next hot market by using intelligent underwriting models driven by machine learning algorithms;

- Gain sophisticated insights by analyzing correlations within external market data and internal company data;

- Optimize returns utilizing data science.

Typical uses cases for Intelligent Underwriting might include the following activities:

- Automatically i) Select the next best acquisition opportunities; ii) Identify hot/cooling markets in real-time; and, iii) Understand why those markets are hot/cooling to define investment and risk management strategies;

- Reduce errors and mistakes in underwriting investment risk and return by mining relevant data directly from the sources, without the need for manual input, upload, analysis and dissemination;

- Determine future price projections for specific projects/neighborhoods and which factors determine the likelihood of higher ROI.

Example of utilizing data science and machine learning in building an acquisition model:

Integrating data mining, machine learning, and semantic indexing from multiple databases such as CB Databank, Pitchbook, Crunchbase, Trepp, Costar, SNL and scoring potential acquisition opportunities according to specific scenarios would result in the list of property owners to contact for potential acquisitions.

Some ideas for prospecting scenarios to build into the model might be:

- Balloon loan maturing in 6 to 9 months;

- Credit upgrade or downgrade on a major tenant,

- Tenant’s recent fundraising event or hiring announcement;

- Tenant’s in the hard-hit sectors (e.g. restaurants without outside dining area);

- Certain macro factor drastically changed in that particular MSA (beware of the reporting time lag, though)

In this particular use case successful research will also enable managers to utilize key macro factors reported by the government such as:

- Local Unemployment growth: Will it increase or decrease the value of certain types of building;

- New construction permits for a metro transit station or other transportation/infrastructure plans that will increase rents and value of commercial buildings;

- Population growth;

- Foot traffic data for Retail or Shipping and Trade data for Industrial.

Machine learning models have potential to lead to significant revenue optimization – identifying predictive insights and correlations among data points that result in better real estate purchases, stronger management and more insightful sales strategies and activity.

They would also create a competitive advantage for a fund during the fundraising process and will positively impact an exit multiple for the operating platform via tech IP ownership.

We are working with real estate funds that are in the acquisition mode. Contact us if you’d like to scale your acquisition strategy using data science Talk to Us