Industry News

| Company Name | Date Filing | Activity Type | Title | Source |

|---|---|---|---|---|

| RISE | 2019-12-12 |

Events

& software solutions

Education

Transaction

|

Unissu launches TED Talk equivalent for global real estate industry | http://www.propertyfundsworld.com/ |

| Cushman & Wakefield | 2019-12-12 |

Weekly newsletter

Office

Transaction

|

PE to fund high-yield property investments in 2020 | http://www.propertyfundsworld.com/ |

| Thor Equities | 2019-12-12 |

Weekly newsletter

Office

Transaction

|

PE to fund high-yield property investments in 2020 | http://www.propertyfundsworld.com/ |

| RISE | 2019-12-12 |

Surveys & research

Office

Retail

Transaction

Fundraising

|

Private equity to be the leading source of capital for high-yield assets in 2020 | http://www.propertyfundsworld.com/ |

| Cushman & Wakefield | 2019-12-12 |

Surveys & research

Office

Retail

Transaction

Fundraising

|

Private equity to be the leading source of capital for high-yield assets in 2020 | http://www.propertyfundsworld.com/ |

| Cushman & Wakefield | 2019-12-11 |

Surveys & research

Education

|

A total of 32,000 new student beds enter UK market as demand rises rapidly | http://www.propertyfundsworld.com/ |

| Thor Equities | 2019-12-11 |

Transaction & Transactions

Acquisitions

|

Thor Equities Group to acquire UK logistics portfolio | http://www.propertyfundsworld.com/ |

| Griffin Capital Corp | 2019-12-11 |

Results & performance

Funds

|

Griffin Institutional Access Real Estate Fund surpasses USD4bn in AUM | http://www.propertyfundsworld.com/ |

| Realm | 2019-12-09 |

Transaction & Transactions

Multifamily

Retail

Land Development

Hotels

Special Purpose

Construction

Joint Venture

Fundraising

|

Hammerson secures planning permission for residential development in Dublin | http://www.propertyfundsworld.com/ |

| Barings | 2019-12-09 |

Lettings & Sales

Transaction & Transactions

Office

Retail

|

Barings sells Nexus Place for GBP169.4m | http://www.propertyfundsworld.com/ |

Company Profiles

| Company | Last Activity | Act. Score | Transactions % vs Comp Set | JV % vs Comp Set | Typical Deal Size | Investor Role | Investment Type |

|---|---|---|---|---|---|---|---|

| 13th Floor Investments | 2025-07-10 | 17 |

599%

|

1454%

|

$10,000,000 - 50,000,000 | Private equity/Investment manager | JV partnership,Acquisition/Fee Simple |

| RSN Property Group | 2024-10-29 | Principal/owner | Acquisition/Fee Simple | ||||

| Ashcroft Capital | 2024-10-29 | 1 |

-91%

|

Principal/owner | |||

| Cresta Properties | 2024-07-10 | 1 |

-83%

|

$999,999 - 10,000,000 | Principal/owner | Acquisition/Fee Simple | |

| Irongate Capital Partners | 2021-09-02 | 1 |

-91%

|

$2,999,999 - 10,000,000 | Private equity/Investment manager | JV partnership | |

| Pebb Capital | 2021-09-02 | 6 |

72%

|

594%

|

$2,000,000 - 50,000,000 | Private equity/Investment manager | Pref/Mezz equity,JV partnership,Acquisition/Fee Simple,Performing/Non-performing loans,Loan Assumptions |

| Virtua Partners | 2021-09-02 | 2 |

-48%

|

-34%

|

Principal/owner | Equity syndication/Club Deal | |

| CrossHarbor Capital Partners | 2021-09-01 | 3 |

12%

|

-1%

|

Private equity/Investment manager | Pref/Mezz equity,JV partnership,Debt | |

| Hamilton Zanze & Co. | 2021-08-31 | 5 |

185%

|

65%

|

$5,000,000 - 10,000,000 | Principal/owner | JV partnership,Acquisition/Fee Simple |

| Fundrise LLC | 2021-08-16 | 5 |

193%

|

65%

|

$1,000,000 - 5,000,000 | Equity syndication/Club Deal |

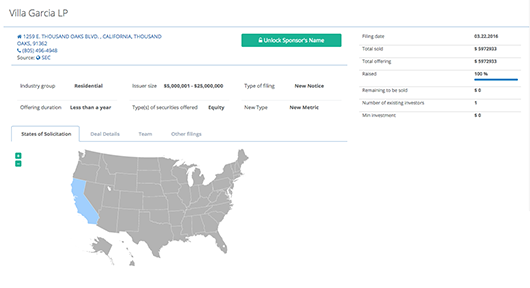

Deal Flow

| Filing Company Name | Date Filing | Company | Total Offering Amount | Total Amount Sold | % Offering Sold |

|---|---|---|---|---|---|

| MADRAS INVESTORS LLC | 2021-09-09 | Unlock Sponsor's Name | $1,184,750 | $0 | 0 |

| Leander BTR LLC | 2021-09-09 | Unlock Sponsor's Name | $2,000,000 | $2,000,000 | 100 |

| Lakeside Development Partners LLC | 2021-09-09 | Unlock Sponsor's Name | $36,000,000 | $0 | 0 |

| Jeff Road Storage Partners, LLC | 2021-09-09 | Unlock Sponsor's Name | $3,350,000 | $2,350,000 | 70 |

| Virtua 35th Holdings, LLC | 2021-09-02 | Unlock Sponsor's Name | $800,000 | $350,000 | 43 |

| Shopoff DLV QOZ Fund, LLC | 2021-09-02 | Unlock Sponsor's Name | $2,000,000,000 | $0 | 0 |

| Griffin Capital Qualified Opportunity Zone Fund II, L.P. | 2021-09-02 | Unlock Sponsor's Name | $249,810,453 | $249,810,453 | 100 |

| CIP Housing Access Partners LLC | 2021-09-02 | Unlock Sponsor's Name | $200,000,000 | $156,900,000 | 78 |

| Wildcat XXXIV, LLC | 2021-09-02 | Unlock Sponsor's Name | $4,100,000 | $4,100,000 | 100 |

| TIMBER CREEK PEAK 15 INVESTORS LLC | 2021-09-02 | Unlock Sponsor's Name | $2,000,000 | $945,000 | 47 |

Everyone Benefits

Brokers

Match your off-market opportunity to the most appropriate buyers based on their real-time investment activity, upload data into CRM or submit directly

Lenders

Start tracking equity offerings and get daily leads on deals that require financing

Developers

Source equity by searching real time profiles of investment managers that place equity in deals like yours

Service Providers

Set alerts and receive accurate updates on prospects that require your services

Discover great features

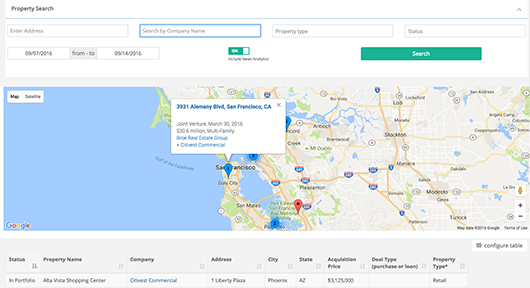

Smarter Prospecting

Learn about prospect’s current investment strategy and fundraising activity in order to market off-market opportunity more efficiently. Immediately identify the best match, submit the Executive Summary directly. Increase your chances acting on up-to-date info.

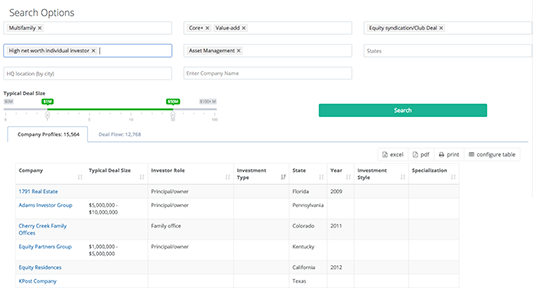

Lead Generation and Predictive Scoring

Don’t waste hours at networking events. Set your parameters and build prospect lists of partners according to their latest market activity. Our proprietary algorithms will sort the results so you can easily decide who to call first.

Better Intel

You maintain your investor prospect list in house, probably in excel. Why mess around with the old list? It’s dead data. Match against your in-house lead list. You upload, we enrich. Quick way to build a prospect list, then enrich those leads with additional data points from our database. Export to CVS. Upload fresh data into your CRM.

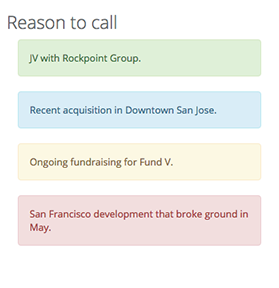

“A reason to call” feature

We turn a cold call into a warm call. When we send you a lead we provide an explanation of why it makes sense to make a connection and why you should reach out to this firm.